## Market Overview: European Log Cabin Industry 2025-2030

The European log cabin and timber building market is experiencing unprecedented growth, driven by sustainability trends, housing affordability concerns, and shifting consumer preferences toward natural building materials. Market analysis indicates the sector will reach €2.8 billion by 2030, representing a compound annual growth rate (CAGR) of 6.8% from 2025 baseline figures of €1.9 billion.

For B2B dealers and distributors, understanding these market dynamics is essential for strategic positioning, inventory planning, and competitive differentiation in an increasingly crowded marketplace.

## Key Growth Drivers Reshaping the Industry

### Sustainability and Environmental Regulations

European environmental directives, particularly the EU Taxonomy for Sustainable Activities and national carbon reduction targets, are accelerating demand for timber construction. Log cabins and glulam homes structures sequester approximately 0.9 tonnes of CO2 per cubic meter of wood used, creating compelling advantages over conventional construction materials.

Germany’s Climate Protection Act mandates 40% emissions reduction by 2030, driving public sector procurement toward timber buildings. This regulatory environment creates substantial opportunities for dealers serving institutional clients and large-scale commercial projects.

### Housing Affordability and Alternative Solutions

With residential property prices increasing 47% across major European markets between 2020-2025, log cabins present cost-effective alternatives for primary residences, vacation homes, and rental properties. Manufactured log cabin structures typically cost €800-1,200 per square meter fully installed, compared to €1,800-2,500 for traditional brick construction.

This price differential is expanding the addressable market beyond traditional vacation property segments into permanent residential applications, particularly in Scandinavia, Alpine regions, and rural UK markets.

### Remote Work and Rural Migration

Post-pandemic remote work adoption remains at 42% in European knowledge sectors, sustaining demand for rural properties and home office solutions. Garden office cabins represent the fastest-growing sub-segment, with 18% year-over-year growth and average transaction values of €8,500-15,000.

Dealers positioned to serve this segment benefit from shorter sales cycles (3-6 weeks average) compared to residential cabins (12-20 weeks) and higher customer lifetime value through accessories and upgrade sales.

## Regional Market Analysis and Opportunities

### Nordic Markets: Mature but Premium

Scandinavia represents 31% of European log cabin volume, with market maturity creating opportunities in premium segments. Norwegian and Swedish consumers demonstrate 73% brand awareness for quality timber manufacturers, supporting premium pricing strategies. Average transaction values in Nordic markets reach €45,000 compared to €28,000 European average.

Dealer margins in these markets typically achieve 28-35% on premium products versus 18-22% on standard offerings, justifying focus on high-specification glulam houses and custom architectural solutions.

### Central European Growth Markets

Germany, Austria, and Switzerland show the strongest growth trajectories at 8.2% CAGR through 2030. German market size will exceed €680 million by 2027, driven by garden building regulations relaxation and sustainability mandates.

Austrian market demonstrates particular strength in premium residential cabins, with 64% of sales exceeding €35,000 transaction values. This market rewards technical expertise and consultative selling approaches, with successful dealers investing in architectural visualization services and building permit support.

### UK and Western European Expansion

United Kingdom market growth accelerated to 11.4% annually following planning regulation reforms for garden buildings under 2.5m height. Current market size of €156 million will reach €245 million by 2029, with particularly strong demand in Southeast England and Scottish Highlands.

French and Benelux markets remain underpenetrated at €142 million combined, offering entry opportunities for dealers with French-language sales capabilities and CE marking expertise.

## Competitive Landscape and Market Positioning

### Manufacturer Consolidation Trends

The market is witnessing consolidation, with the top 15 manufacturers now controlling 43% of European production capacity, up from 31% in 2020. This concentration creates challenges for smaller independent dealers but opportunities for exclusive distribution partnerships with emerging manufacturers.

private-label partnership model and private-label arrangements are growing at 12% annually, enabling larger dealer groups to differentiate through proprietary product lines while maintaining competitive pricing through manufacturing partnerships.

### Price Segmentation Dynamics

Clear market segmentation has emerged across three price tiers:

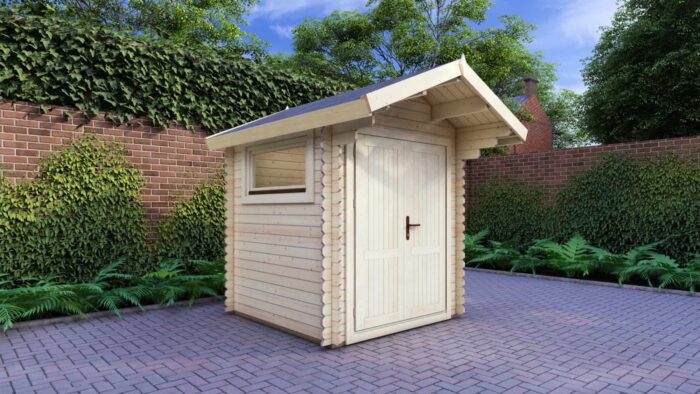

**Economy Segment (€8,000-18,000):** 41% of unit volume, focused on garden sheds and basic cabins with 44mm walls. Competitive intensity highest in this segment with average dealer margins of 15-19%.

**Mid-Market (€18,000-45,000):** 38% of volume, representing residential garden rooms and small vacation cabins with 70-92mm walls. Optimal segment for balanced volume and margin at 22-28%.

**Premium (€45,000+):** 21% of volume but 34% of total market value. Glulam houses, architectural designs, and large residential cabins. Margins reach 30-38% but require significant technical expertise and longer sales cycles.

## Technology and Distribution Evolution

### Digital Transformation Impact

Online research influences 84% of log cabin purchases, with buyers conducting average 11.3 hours of digital research before dealer contact. Successful dealers are investing in virtual configurators, 3D visualization tools, and comprehensive online specification resources.

E-commerce direct sales remain limited to 7% of market volume, primarily in garden shed segment under €6,000. Complex cabin sales continue requiring dealer expertise for site assessment, foundation specification, and permit navigation.

### Supply Chain and Lead Time Considerations

Manufacturing lead times have stabilized at 6-8 weeks for standard products following pandemic-era disruptions, though custom orders still require 12-16 weeks. Dealers maintaining demonstration inventory and offering “quick-ship” programs achieve 23% higher conversion rates and premium pricing power.

Logistics costs represent 8-12% of delivered product cost, creating competitive advantages for dealers with regional warehousing and local delivery capabilities. Containerized shipping from Baltic manufacturers to Western European markets adds €2,800-4,200 per container, influencing optimal order quantities and inventory strategies.

## Strategic Implications for B2B Dealers

### Market Entry and Expansion Timing

Current market conditions favor dealer expansion and new market entry. Manufacturing capacity utilization averaging 73% provides negotiating leverage for dealer partnerships and favorable payment terms. Emerging manufacturers seeking distribution networks offer opportunities for exclusive territorial rights.

Dealer establishment costs have decreased 18% since 2022 as digital marketing channels reduce requirements for expensive physical showrooms. Successful new dealers report breakeven at €320,000-450,000 annual revenue, achievable within 14-18 months with proper market positioning.

### Product Portfolio Optimization

Data indicates optimal portfolio breadth of 15-25 standard models across multiple price tiers, supplemented by customization options. Dealers offering fewer than 12 models sacrifice revenue opportunities, while those exceeding 30 models create customer confusion and inventory challenges.

Garden office and home workspace products should represent minimum 25% of portfolio focus given growth rates and margin potential. Integration of complementary products (foundations, installation services, interior fit-out) increases average transaction value by 32% and creates competitive differentiation.

### Competitive Differentiation Strategies

Successful dealers are differentiating through specialized expertise rather than price competition. Technical certifications, architectural visualization services, building permit assistance, and installation quality programs support premium positioning. Dealers emphasizing service capabilities achieve 27% higher margins than price-focused competitors.

Customer education content marketing generates 3.2x more qualified leads than traditional advertising at one-quarter the cost per acquisition. Investment in comprehensive buying guides, specification tools, and comparison resources aligns with modern B2B buying behaviors.

## Future Outlook and Preparation

European log cabin market fundamentals remain strong through 2030, supported by regulatory tailwinds, affordability advantages, and sustainability megatrends. Smart dealers are positioning now for next-phase growth through manufacturer partnerships, digital capability development, and service-based differentiation.

The transition from product-focused commodity sales to solution-based consulting relationships will separate market leaders from struggling competitors. Dealers investing in technical expertise, customer education, and comprehensive service offerings will capture disproportionate value in this expanding market.

For the Eurodita B2B dealer network, these market dynamics present exceptional opportunities for profitable growth through 2030 and beyond, particularly for partners willing to invest in capabilities that align with evolving customer expectations and market requirements.

Request a B2B partnership quotation